The Minneapolis City Assessor’s office exists to estimate the value of every property in the city, which then becomes the basis for property taxes paid in Minneapolis. These estimates are compared to real sales to ensure that estimates are reasonable.

The city assessor presented 2024 total estimated property values to the City Council this month, reporting a decline of 3.1% from 2023 to 2024.

In 2023, the total estimated property value of all property in the city was $67.5 billion dollars. In 2024, the total estimated value was only $65.4 billion dollars, a loss of $2.1 billion dollars in one year.

Existing single family homes collectively lost 1.2% of their value citywide, while apartments lost 9.5% of their value and commercial properties lost 8.7% of their value from 2023 to 2024.

Downtown commercial property saw the largest decline, with a 13% decline in value. Uptown commercial property lost only 0.8% of its total value.

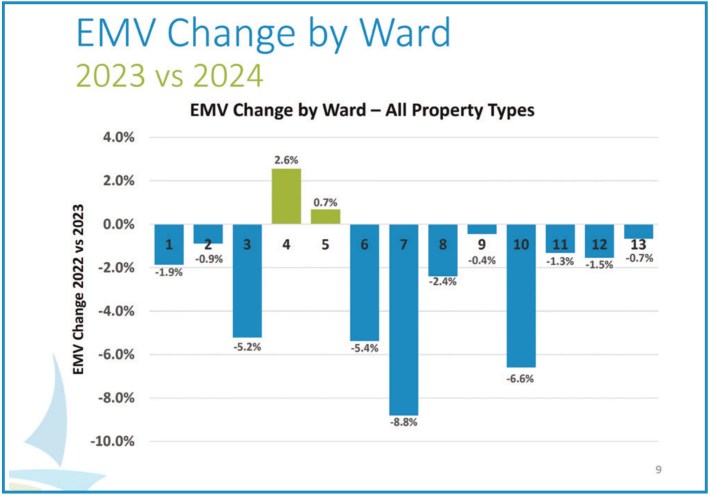

This decline did not occur evenly across the city. Total estimated property value actually increased in North Minneapolis, while the largest decline was in city council wards that at least partially included downtown commercial property.

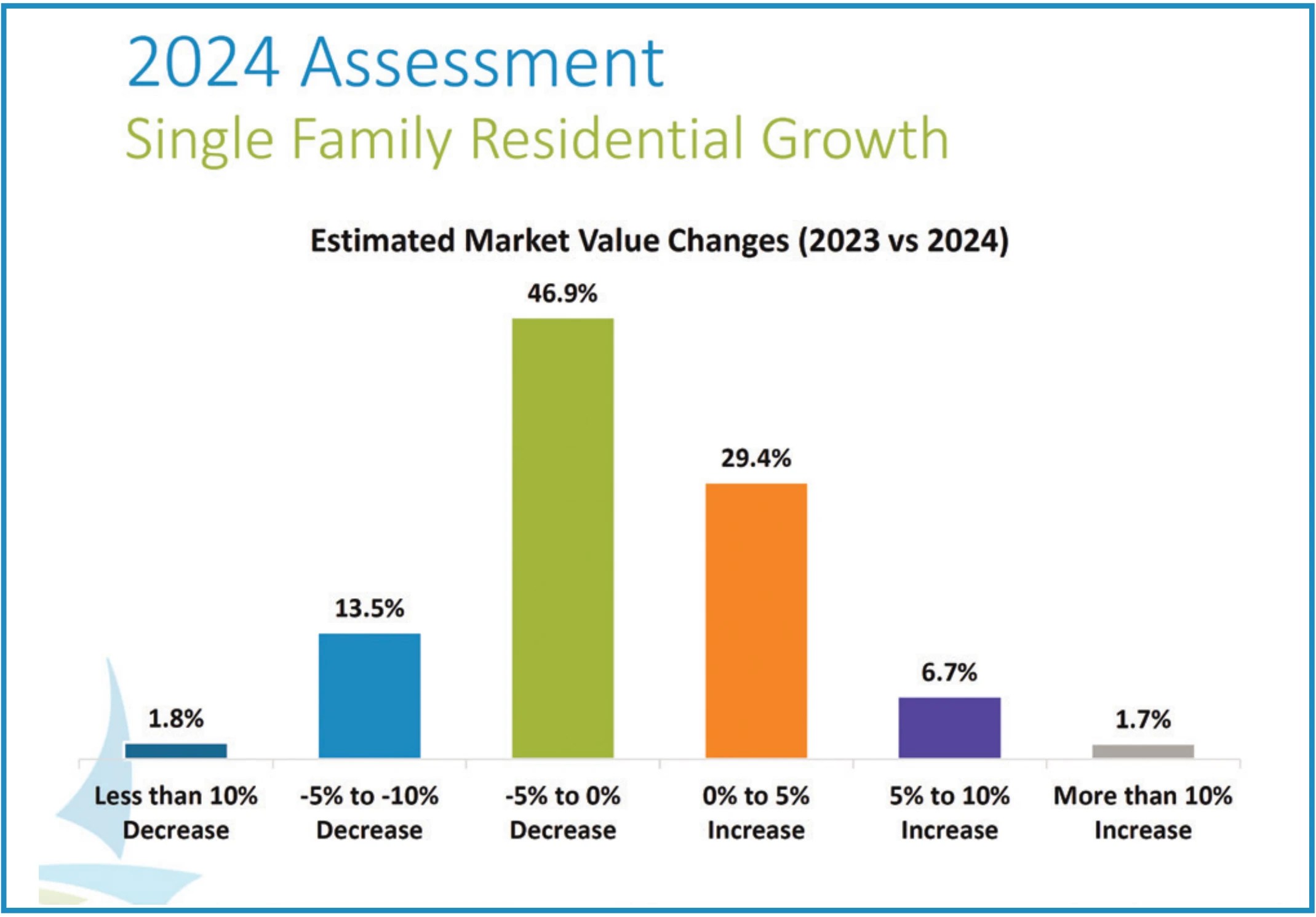

At 62.2% of single-family homes saw declining home values, while 37.8% of houses saw increases.

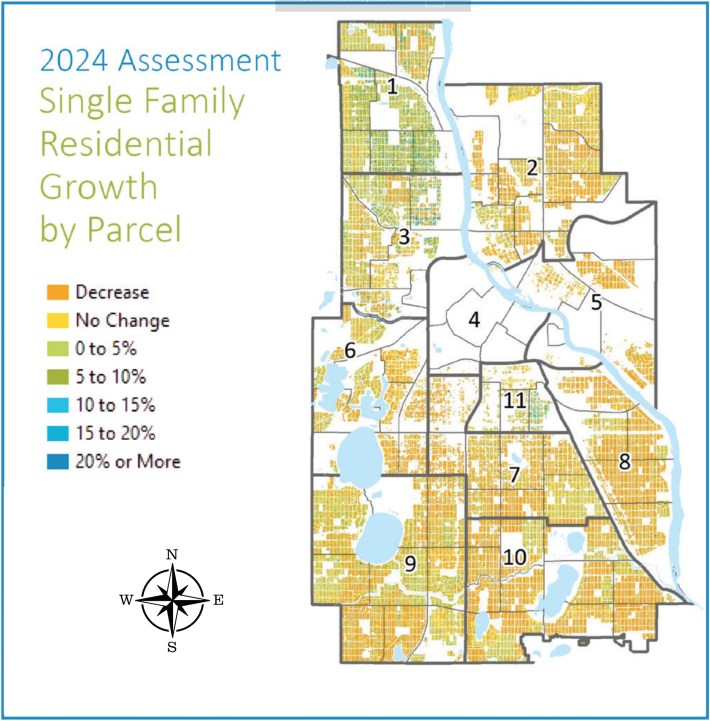

Changes in single-family home value did not occur evenly around the city. Total estimated value in North Minneapolis increased but decreased in other parts of the city.

These property values will be used as the basis for 2025 property taxes. Overall, residential property owners will generally see an increase in taxes next year, as the tax burden shifts off commercial and rental properties. How much? The amount will vary by property, and residents will need to wait until they get their Truth in Taxation statements next year.